An Ideal Option for Debt Consolidation

Mrs. Chan - Housewife

———

Mrs. Chan’s daughter has a monthly income of only HK$15,000, but has an average monthly credit card bill of over HK$10,000. As she can only afford to make minimum payments, her total loan balances^ have increased to HK$800,000. Realizing that it will likely to take her more than 5 years to pay off the loans, she seeks help from Mrs Chan who decides to apply for a “cash-out” refinance of her residential property valued at HK$7.5 million. Getting loan approval for a cash-based employee like Mrs Chan without salary slips and a tax demand note is not easy.

Referred by a friend, Mrs Chan contacts Sun Hung Kai Credit and its professional team of experts provides her with various optimal solutions. With her daughter’s boyfriend, who has a stable income proof and can provide proof of income agreed to be the joint applicant, the HK$800,000 loan is granted quickly. By clearing all credit card and loan balances, Mrs Chan helps ease her daughter’s financial burden. Her daughter also promised not to overspend in the future, and the relationship between the mother and daughter is better than before.

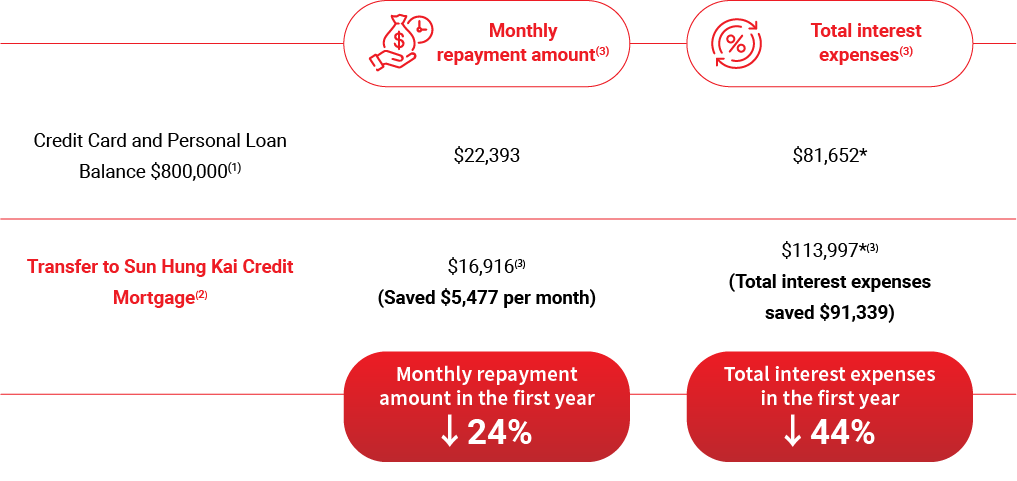

^ Including outstanding credit card & personal loan balances * Calculated based on the first 12 months

(1) Assuming that the credit card loan amount is $300,000, the monthly flat rate is 2%, and the actual annual interest rate is 42.24%; also assuming that the personal loan amount is $500,000, the monthly flat rate is 1.5%, and the actual annual interest rate is 35.81%;

(2) Assuming that the actual annual interest rate of the mortgage loan is 15%;

(3) Assuming that the repayment amount and interest expenses are calculated in 72 instalments

Successful Case Sharing

© Copyright Sun Hung Kai Credit Limited 2025

Money Lender’s Licence No.: 0752/2025

Warning: You have to repay your loans. Don’t pay any intermediaries.

Complaint Hotline: 2996 2600